How To Get Into Hedge Funds

How to Get a Hedge Fund Job?

In order to get into the hedge fund, person is required to fulfill the required educational qualifications and the skills criteria, get the master's degree like CFA and the CAIA even if they are not compulsory as it helps in getting the better jobs, and get the knowledge about the industry by doing internship at the hedge fund and work on the different skills such as Financial Modeling Skills, Deep knowledge in investing and finance, etc.

Explanation

Getting into a hedge fund is no cakewalk. And it's not for the faint-hearted. Hedge fund managers are the ultimate source of industry knowledge, investment skills, and flawless execution on the deliverables (because so much money is at stake). If you would like to get into a hedge fund, here's what you should start with i.e., understanding how it is to be a hedge fund professional.

The first thing that should be mentioned first. There are a few requirements if you ever want to get into hedge funds. They're not earth-shattering in nature, but not an easy list to tick off as well –

- Do you study all the time about investments, market scenarios, ups & downs of stocks, etc.?

- Do you have original ideas about investments and can implement them right away?

- Are you involved in investments in stocks? If you don't do investment yourself, you won't ever know how it is to be into hedge funds.

- Do you want to put in the arduous effort day in and day out for at least 4-6 years?

The above pre-requisites are relative. However, if you tick off "yes" to all of them, then you won't face any issues in getting into hedge funds. But if you say "no" to any of the above questions, think back, and reconsider your stance.

Types of Hedge Fund Jobs

Now, let's talk about how it is to be a hedge fund professional.

In Hedge Fund, there are two types of hedge fund jobs Hedge fund jobs are very popular among people in the finance industry because they can earn lucrative salaries. Some of the jobs available in hedge funds include fund manager, analyst, sales manager, marketing manager, and accountant. read more you can take – first, you can work in the front office, which most people aim for, and second, you can work in the back office.

As the front office is the most attractive path in a hedge fund, we will discuss this in detail.

Usually, there are three options you have in the front office –

#1 – Traders

These people are also called Execution Traders (ET). There are two types of ET in a typical hedge fund. First, some traders generate new ideas and execute them. Second, some traders only execute others' opinions.

source: indeed.com

#2 – Investment Analysts (IA):

These are the people who put in the arduous effort to do the research, generate new ideas, and help the top-level managers make a prudent decision. There are two rungs in investment analysts' position – junior analysts and senior analysts. These investment analysts An investment analyst is an individual or firm that excels in the financial and investment research and have a keen knowledge of financial instruments and models. Such financial professionals include portfolio managers, investment advisors, brokerage firms, mutual fund companies, investment banks, etc. read more are also called Research Analysts.

source: indeed.com

#3 – Portfolio Managers:

These people are the bosses and sit at the highest rung. They decide where to make the investment and what to buy/sell. Portfolio managers A Portfolio Manager is an executive responsible for making investment decisions & handle investment portfolios for fulfilling the client's investment-related objectives. Also, he/she works towards maximizing the benefits & minimizing the potential risks for clients. read more go to the research analysts Research analyst is a profession where the main task includes research on specific fields, analyzing the facts and figures, interpreting the analysis, and finally presenting the same to a structured audience that can relate to marketing, finance, operations. read more and ask questions about their findings. And if there is any concern, the research analysts are invited to revisit the research report to provide a sound recommendation. Then the portfolio managers take the final call and instruct the traders to buy/sell everything at the right price.

source: indeed.com

So, now let's talk about the back office briefly.

In the back office, you need people to support the primary function. Since the chief attraction of the hedge fund is "front office," people at the back office don't get the limelight. These people are technology people who support the system, administrative ninjas who keep things tidy and take care of minute details, and CFOs. They take care of the whole finance function of the organization.

If you would like to get into a hedge fund (front office), you can start as a junior analyst/trader in a small/big hedge fund and get promoted eventually.

Hedge Fund Job – Educational Qualifications

source: indeed.com

The correct answer regarding the qualification of a hedge fund manager is this – "you don't need any qualification to be a hedge fund manager except few certifications."

But usually, people who handle large funds (AUM $5-10 million or even more) are from prestigious universities. And they have impeccable knowledge in one or more areas they work in, e.g., foreign currency, oranges, oil, stocks, gold, coffee, retail stocks, etc.

So, do you need to have elite qualifications to make a mark in the hedge fund?

Of course, yes.

If you have excellent qualifications, it would certainly make things easier for you.

For example, if you have a bachelor's and master's degree in Finance/Mathematics/Economics from a reputed university, the knowledge will certainly help you make better decisions than a layman who has no experience whatsoever in finance/relevant fields.

If you don't want to go to that sort of pedagogy, you can do a crash course in Finance and get started.

Have a look at the guide below, which may help you tread the path of hedge fund well –

- Choose commerce: The first step is simple. After the 10th Standard, choose commerce with accounting and economics.

- Pursue a bachelor's degree in accounting/finance: Consider pursuing a top-notch accounting or finance degree after your 10+2.

- Go for a master's degree to achieve an extra edge: Though it is not mandatory to go for a master's degree, you can ensure that you're not among the crowd by pursuing a master degree from a prestigious university in finance/accounting/economics.

- Additional qualifications: You can also pursue CFA to get a hold of investment analysis Investment analysis is the method adopted by analysts to evaluate the investment opportunities, profitability, and associated risks in their portfolios. In addition, it helps them to determine whether the investment is worth it or not. read more . You may also pursue an MBA from a prestigious university and can also earn a quant-focused Ph.D.

- Get experience: To make your mark in the hedge fund industry, you need to know the financial sector through and through. Few years of experience in the specified field will significantly help.

- Get licensed: To start as a hedge fund manager, you need to get licensed through the Financial Industry Regulatory Authority.

- Become the best in your area of expertise: You need to know everything about a specific industry. This "everything" includes so much that you should be the only person who knows about it.

Follow this simple framework, and it will nudge to have a great career in a hedge fund.

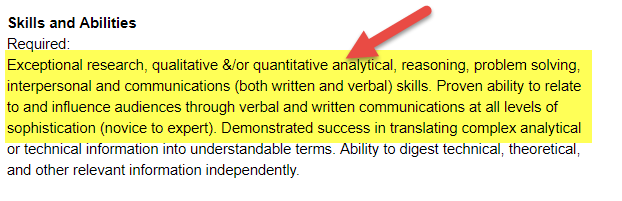

Hedge Fund Skills required

source: indeed.com

Without any ado, let's get to the look at the skills you must have to get into hedge fund –

- Intuition: Most people may not consider this as a skill, but to a hedge fund manager, this is the essential skill to have. Instinct is a skill that comes with a lot of repetitive practice. If you are continually studying a subject (let's say investment in gold), after a while, you would be able to connect various unrelated ideas into a concrete, recognizable pattern you can implement successfully in picking and choosing investments. Intuition will only be developed by repetition, and you will know when you will have it.

- Quantitative Analysis: This is one of the essential skills to have if you want to do great work in the hedge fund industry. The best way to develop quantitative analysis skills is to go for a quant-related job where you need to do a lot of analyses and to provide a lot of recommendations regularly. You can opt for an economist position or a financial analyst position. Another way to build quant skill is to pursue higher studies and do a quant-specific Ph. D. to go into in-depth studies of various quantitative models.

- Investment management: This should be your forte. If you know how to manage investments, you will fulfill one of the topmost requirements of the small/significant hedge funds. To develop this skill, you can start investing on your own (if you don't have the background). Start early so that you can have a few years of experience before you step into a hedge fund career. Practicing investments on your own will teach you two things – first, how to mitigate the risk as much as you can, and second, how you can maximize the return on your portfolio. These two skills will be invaluable to you when you would apply for any hedge fund job.

- Initiation: Most people think initiation can't be measured. But if you work for a week in a firm, anyone would be able to tell you whether you have an initiation or not. If you're genuinely willing to make a stir in the hedge fund, then you will have initiation in knowing it all because people who are attached to any hedge fund are the most knowledgeable in the industry. Without initiation, you can't acquire immense knowledge and master skills required in the hedge fund industry.

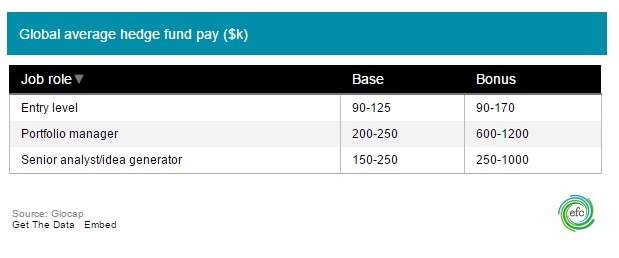

Hedge Fund Salary & Work-life balance

The basic rule of the hedge fund is to follow the "2-20" rule. According to this rule, any hedge fund will earn a 2% management fee on the total assets under management (AUM). The hedge fund will also get a 20% bonus on any gain it has made during a specific period.

So the pay varies drastically. However, as you would be working under someone else, in the beginning, you need to know a range of compensation you would get once you enter into the hedge fund.

According to executive search firm Glocap, entry-level professionals would earn a basic compensation of around $90,000 to $125,000 per annum. But it's possible to make the same amount in bonus and earn approximately $295,000 per annum as total compensation.

Let's have a look at the compensation details of hedge fund professionals below –

source: efinancialcareers.com

From the above data, it's clear that hedge fund professionals earn decent money as they gain more experience.

But the trick in earning more compensation in the hedge fund is to stop being an employee and try to be a partner. As a partner, you will invest money into the hedge fund and usually will make a discretionary part of the profit that the fund will make.

When it comes down to the working hours in a hedge fund, you will work much lesser than investment banking or private equity jobs. You don't need to put in 100+ hours in the hedge fund. All you need is 70 hours work week. Most of the professionals who work in hedge funds usually work 50-70 hours per week. That means hedge fund managers enjoy an outstanding work-life balance irrespective of earning so much at the end of the year.

Strategies to get into Hedge Fund

Here are a few things you should keep in mind if you want to get into hedge fund –

#1 – Get accustomed to the recruitment process:

Hedge fund interviews are much different and extended than investment banking interviews The purpose of this Investment Banking Interview Questions and Answers is simply to help you learn about the investment banking interview topics. read more .

- You will be having general rounds – fit round, HR round, and partner round. Along with that, you need to go through a case study analysis session. You will be given a time of a few days, and you will be provided with an income statement, a balance sheet, and a cash flow statement Statement of Cash flow is a statement in financial accounting which reports the details about the cash generated and the cash outflow of the company during a particular accounting period under consideration from the different activities i.e., operating activities, investing activities and financing activities. read more of a company. And then, you will be asked to prepare a one-page briefing of the valuation of the company.

- Know what questions are asked during interviews in hedge funds. Four questions that are usually asked in a hedge fund interview are – (1) Brief about your background (Tell your structured story); (2) Why hedge fund? (Be specific in your answer); (3) Have you done any investing? If yes, what sort of? (Share your experience); (4) Which stocks are your favorite? And why? (Mention your preference and remark why these are your preference).

#2 – Do internships:

The only way to learn about trade-secret is to become an intern. If you are from different background and don't have any knowledge in a hedge fund, you can read a lot about hedge funds and then do a couple of internships. These internships should be in hedge funds directly so you can get an idea of how things work there.

#3 – Network:

Networking is the key. You may not have the required background or knowledge as of now. But if you know enough people from the industry, things would become much easier for you. Of course, you need to acquire the skills and gain the knowledge base, but you will still be way ahead of someone who never tried networking.

#4 – Stick and try to achieve a partner status:

Don't leave hedge funds if you face failures initially. The market is volatile, and the risk is on the higher side. But if you stick to it, eventually, you will gain a partner status, and within a few years, you would be able to retire and start something on your own.

Conclusion

The hedge fund is not for the crowd. If you want to get into a hedge fund and make money and you have an appetite for risk-taking, you have the perfect combination to become a hedge fund manager. However, the road is slippery and not always rosy. You need to be steady and keep pushing yourself to become the best in the industry.

How to Get Into Hedge Fund? Video

Recommended Articles

This has been a guide to how to get into a Hedge Fund Job? Here we discuss hedge fund jobs, education and skills requirement, hedge fund salaries, and top strategies to get an interview at the hedge fund. You may learn more about Hedge Funds from the following article –

- Hedge Fund Strategies

- Funds of Funds

- Top 20 Hedge Fund Interview Questions

- Hedge Funds Course

- Top 10 Best Hedge Fund Books

How To Get Into Hedge Funds

Source: https://www.wallstreetmojo.com/how-to-get-into-hedge-fund/#:~:text=In%20order%20to%20get%20into,by%20doing%20internship%20at%20the

Posted by: farrararkmadesain.blogspot.com

0 Response to "How To Get Into Hedge Funds"

Post a Comment